You’re out shopping for a new car or home and the dealer asks about your credit score. That three-digit number is more than just a grade, it’s how lenders size you up. But what is a credit score anyway and why does it matter so much? Banks and lenders use your score to decide if you can get a loan and what interest rate you’ll pay. A higher number means you look like a better bet to pay back the money you borrow. But how do the credit bureaus calculate this mysterious number? And what can you do to boost your score or fix mistakes on your reports? Stick around as we lift the veil on credit scoring to help you understand what’s behind the numbers. You’ll learn the factors that shape your score, how to access your reports, and tips to manage your credit wisely.

What Is a Credit Score and Why Does It Matter?

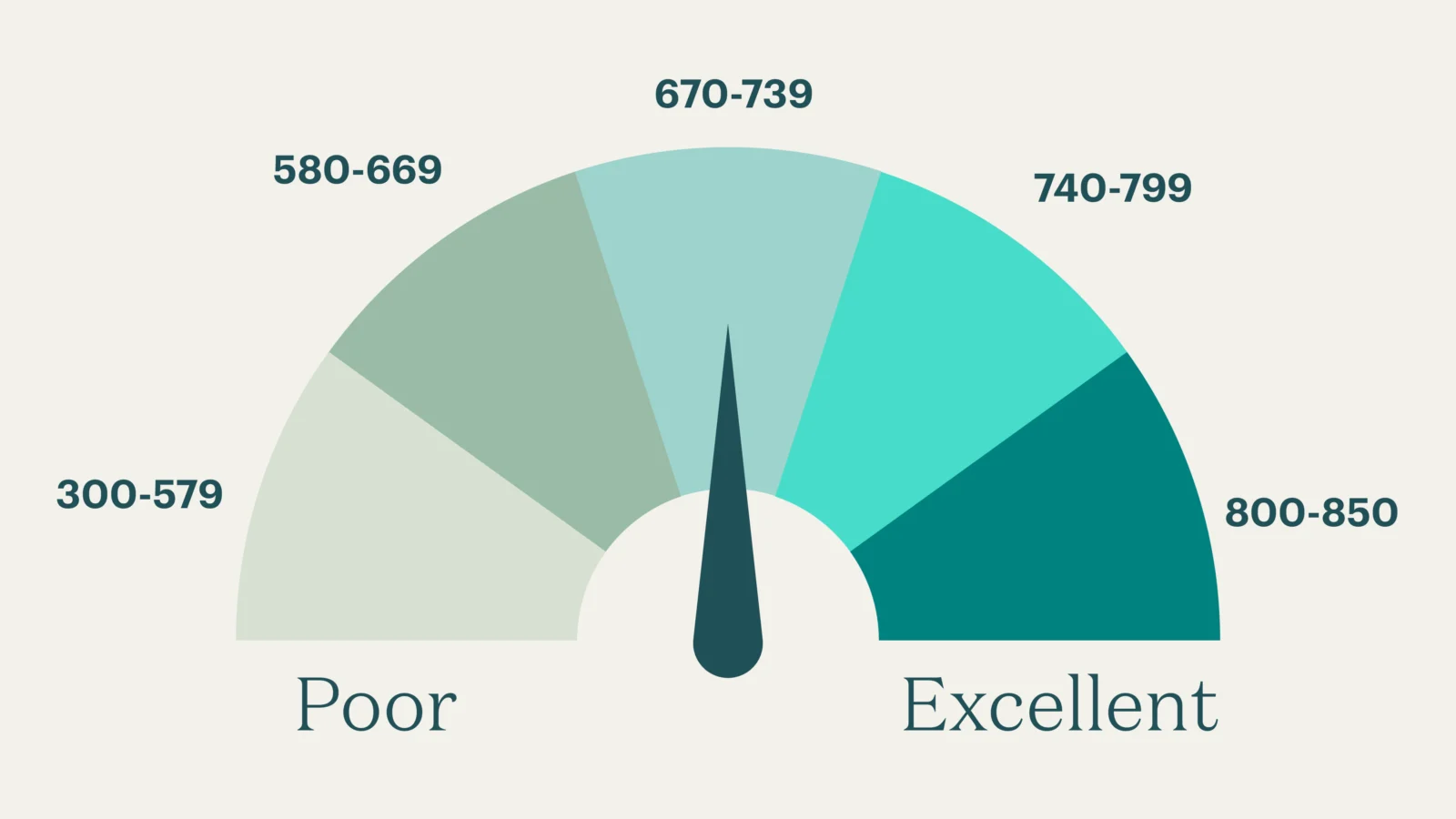

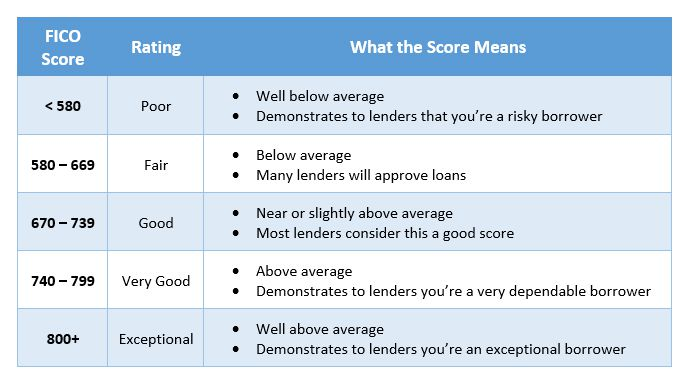

Your credit score is a three-digit number that lets lenders know how risky it is to lend you money. The higher your score, the less risky you seem and the more likely you’ll qualify for loans and credit cards with good terms.

Your Credit Score Determines Your Financial Opportunities

A good score opens you up to the best interest rates and loan terms, which can save you thousands over the life of a mortgage or auto loan. A bad score can limit you to predatory lenders and sky-high interest rates – if you can get approved at all.

Many Factors Influence Your Score

The most influential factors are your payment history, amounts owed, length of credit history, new credit, and credit mix. Late or missed payments severely hurt your score. High balances on revolving credit like credit cards also damage your score. A good mix of accounts in your credit history, like installment loans, credit cards, and a mortgage, helps your score.

How to Improve Your Score

Pay bills on time, pay down high balances, limit new applications, and check your credit report for errors. As you build good financial habits, your score will improve over time. While raising your score can take patience, the benefits to your financial well-being make it worth the effort. Monitoring your score and the factors influencing it is an important step to gaining control of your financial life.

How Credit Scores Are Calculated and Factors That Impact Your Score

Your Credit History

Your credit score is calculated based on information in your credit report, including your payment history, amounts owed, length of credit history, new credit, and credit mix. Your payment history makes up the largest portion of your score. Late or missed payments severely hurt your score while a solid record of on-time payments helps raise it.

Amounts Owed

The amounts you owe on revolving credit like credit cards and lines of credit also impact your score. High balances on your credit cards and other revolving accounts can lower your score. It’s best to keep balances low relative to your limits.

Length of Credit History

In general, the longer your credit history, the better. A longer credit history means there is more information to determine your score and it shows you can responsibly use credit over time. However, don’t close old accounts just to raise your score.

New Credit

Applying for a lot of new credit quickly can lower your score. New credit inquiries and new accounts can make it seem like you have a greater risk of default. Only apply for new credit when needed and try to limit the number of hard inquiries whenever possible.

Credit Mix

Having a good mix of accounts in your credit history, such as installment loans, credit cards, finance company accounts, and mortgage loans can help your score. But don’t open accounts you don’t need just to add more types of credit.

Paying attention to all these factors and using credit responsibly over time is the key to building and maintaining a good score. Check your credit report and score regularly to make sure there are no errors and you’re on track to meet your financial goals.

Tips to Improve Your Credit Score and Achieve Financial Health

To boost your credit score, focus on a few key habits. Pay all your bills on time. Payment history makes up 35% of your score, so make on-time payments a priority. If needed, set up automatic payments to avoid missed payments. Keep low balances on credit cards. High balances hurt your score and indicate risk to lenders. Pay down your balances to 30% or less of your limits. Limit new applications. Applying for a lot of new credit quickly can lower your score. Only apply for new credit when needed. Check your credit report regularly. Look for any errors that could hurt your score and dispute them. Monitor your score and report for signs of fraud.

Pay off debt and cut spending. The less you owe and the less you spend each month, the better. Make a budget to understand your cash flow. Look for expenses you can reduce or eliminate. Put any extra money toward paying off high-interest debts like credit cards. As debts are paid off, your score should start to improve. Once you have a good payment pattern and low balances, consider asking for credit line increases. Higher limits will further improve your credit utilization ratio.

Keep using credit responsibly. Continue paying on time and keeping low balances even after your score has improved. Staying in good financial habits will ensure your score remains in a healthy range. Periodically check your score and reports to make sure there are no issues. Maintaining good credit is a lifelong effort, but the rewards of financial health and stability are well worth it.

Conclusion

So there you have it. Your credit score is like your financial report card. It shows lenders how responsible you are with credit and money management. The higher your score, the better odds you’ll qualify for loans at good rates. If your score needs help, focus on paying bills on time, lowering balances, and limiting new credit applications. Building good credit takes effort, but it’s worth it. With a strong score, you’ll have the keys to unlock major purchases like a home or car and enjoy financial flexibility. Keep tabs on your credit by reviewing reports annually and challenging any errors. Your score doesn’t define you, but it does impact your borrowing power. Use that knowledge to make informed choices that steadily strengthen your financial foundation over time.